In Light Of The International Day Of Micro Small And Medium Enterprises (MSMEs), Celebrated Around The World On June 27Th Every Year.

In Light Of The International Day Of Micro Small And Medium Enterprises (MSMEs), Celebrated Around The World On June 27 Th Every Year, a Digital Dialogue was organised on ‘Digitizing MSMEs for a Digital Pakistan’. The session shed light on how digitization can work towards transforming the current financial ecosystem for micro and small enterprises across Pakistan.

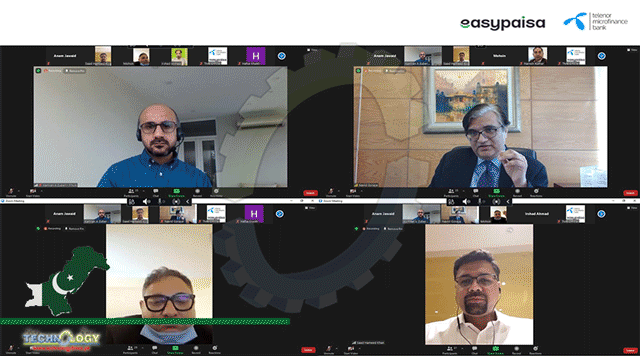

The session was hosted by Saad Hameed Khan, Head of Lending Transformation & Digitization – Easypaisa / Telenor Microfinance Bank, and the panel comprised renowned industry leaders, including Syed Mohsin Ahmed, Chief Executive Officer – Pakistan Microfinance Network, Navid Goraya, Chief Investment Officer – Karandaaz Pakistan and Kamran A. Zuberi, Chief Executive Officer – Finja Lending Services Ltd.

MSMEs form the backbone of Pakistan’s economic infrastructure contributing 40% to the country’s exports and an equal amount to the overall GDP. However, the sector is facing various challenges today, the most prominent one being lack of access to financial services and resultantly, limited access to formal credit. This challenge can be addressed by digitizing MSMEs and bringing them into the fold of financial services through digital payments and lending services.

During the session, panelists discussed that the only credit available to SMEs is 7% of the total private lending whereas in other regional markets it is as high as 30% or more. Similarly, just 1% of the country’s GDP is given to SMEs as credit. In other South Asian countries, this percentage ranges all the way up to about 9% to 10%. Naturally, given the constraints that are being put from the supply side on to the SME sector, there is less incentive for them to organize themselves and borrow or digitize.

Participants also highlighted that the behavioral change in MSMEs will only be possible when there is no friction, which comes in the form of pricing. In order to go cashless, the costs associated with digital payments need to be incentivized as it is extremely sensitive to customers across the board.

It was also noted that the way to tackle the challenges faced by the MSME sector is by not perceiving digitization as just a tool for documenting the economy. That can be the by-product of a financially inclusive society but not its holistic objective. This approach will alter the way policies/frameworks are developed and allow enhancement of inclusive finance through digitization.

Pakistan’s microfinance institutions have made substantial strides over the years in developing relevant digital infrastructures for not just individual customers but MSMEs as well. By minimizing the need for complex documentation and digitizing transactions, the country’s most prudent business sector can work wonders for itself and for the overall economy as well.

The webinar can be viewed online through this link: https://youtu.be/7TpAQr9keco