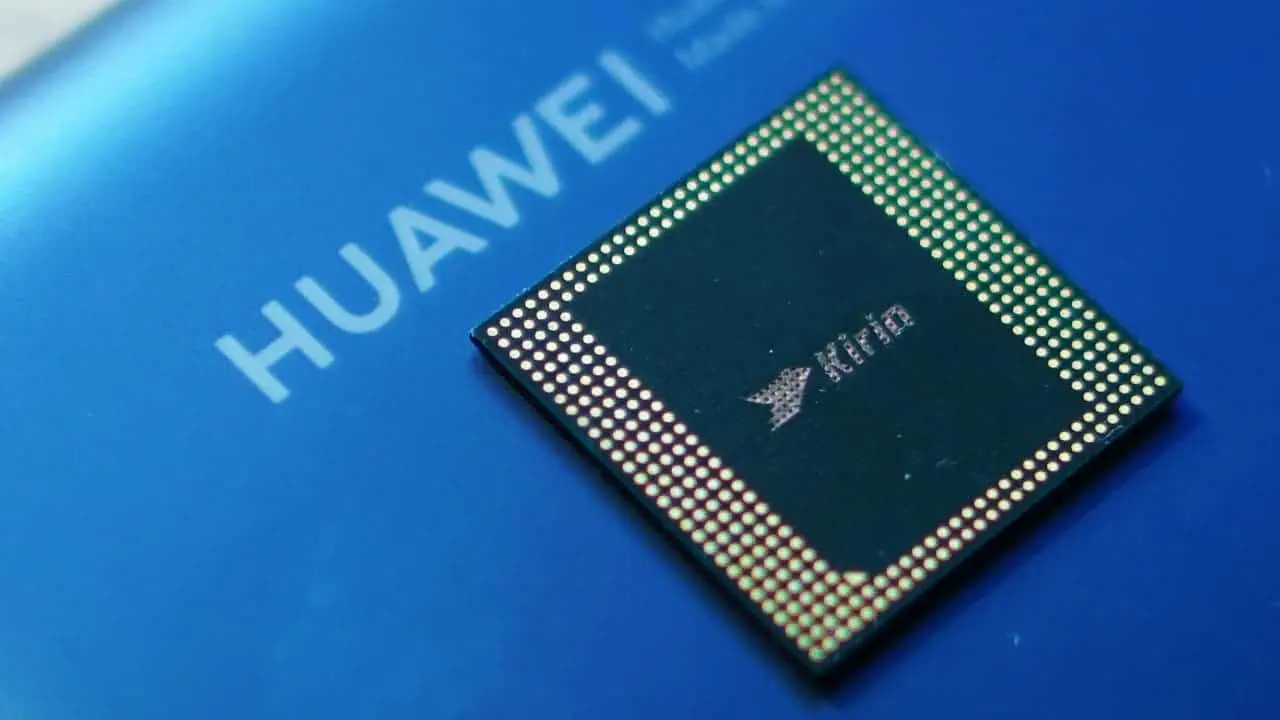

In a strategic move, Huawei has unveiled its latest flagship Mate 60 series, featuring the Kirin 9000S chip, marking a significant shift away from Qualcomm’s offerings.

In a strategic move, Huawei has unveiled its latest flagship Mate 60 series, featuring the Kirin 9000S chip, marking a significant shift away from Qualcomm’s offerings.

This bold step signifies Huawei’s determination to forge ahead despite the enduring US trade ban, which bars the company from accessing American 5G technology. While the Kirin 9000S chip may not match the raw power and efficiency of the top-tier Snapdragon SoC, it holds promise in reinvigorating Huawei’s standing in the market.

Huawei, once one of Qualcomm’s most substantial clients for System on Chips (SoCs), had procured up to 25 million units from the American chipmaker in 2022, a figure that surged to an estimated 40-42 million in 2023. Analyst Ming-Chi Kuo now indicates Huawei’s intentions to entirely transition to Kirin SoCs in 2024, a move that could result in Qualcomm facing a staggering drop of 50 to 60 million shipments in the coming year.

With Qualcomm’s next flagship chip, the Snapdragon 8 Gen 3, anticipated to be priced at $180 per unit, a potential loss of 60 million shipments translates to a colossal financial setback of $10.8 billion for the American tech giant.

While Huawei has not yet disclosed any plans to extend the distribution of Kirin SoCs to other Chinese phone manufacturers, should such a move materialize, it is likely that they would offer a more cost-effective alternative compared to the rumored price increase for the Snapdragon 8 Gen 3.

Qualcomm is also poised to face competition from Samsung’s Exynos 2400, set to make its debut in select markets alongside the Galaxy S24 lineup. This new entrant could further intensify the market dynamics and compel Qualcomm to adapt its strategies accordingly.

In the wake of Huawei’s resolute push towards self-reliance in chip production, the tech industry is poised for a shift in the balance of power, with Qualcomm bracing for a potentially seismic financial blow. As the landscape evolves, it remains to be seen how Qualcomm will navigate these turbulent waters in the fiercely competitive world of semiconductor technology.