Wang’s prediction stems from a belief that shipments of copper ore from overseas mines will outpace the expanding processing capacity of China’s smelters.

Wang Wei, head of copper trading at Shanghai Wooray Metals Group Co., one of China’s largest copper dealers, forecasted a potential oversupply in the world copper market for the upcoming year in a recent interview. This information is anticipated to trigger more drops in the commodity, which is essential to the energy transition.

Wang’s prediction stems from a belief that shipments of copper ore from overseas mines will outpace the expanding processing capacity of China’s smelters. Despite this seemingly reassuring scenario for Chinese smelters, Wang is not optimistic about copper prices, stating that the market will be at its “loosest” next year. He points to potential tightening conditions in the long run due to increased Chinese stimulus measures and a depletion of ore reserves.

This perspective aligns with observations within China’s copper market. However, Goldman Sachs Group Inc. and other entities hold a more bullish outlook, foreseeing increased demand for copper driven by the global energy transition.

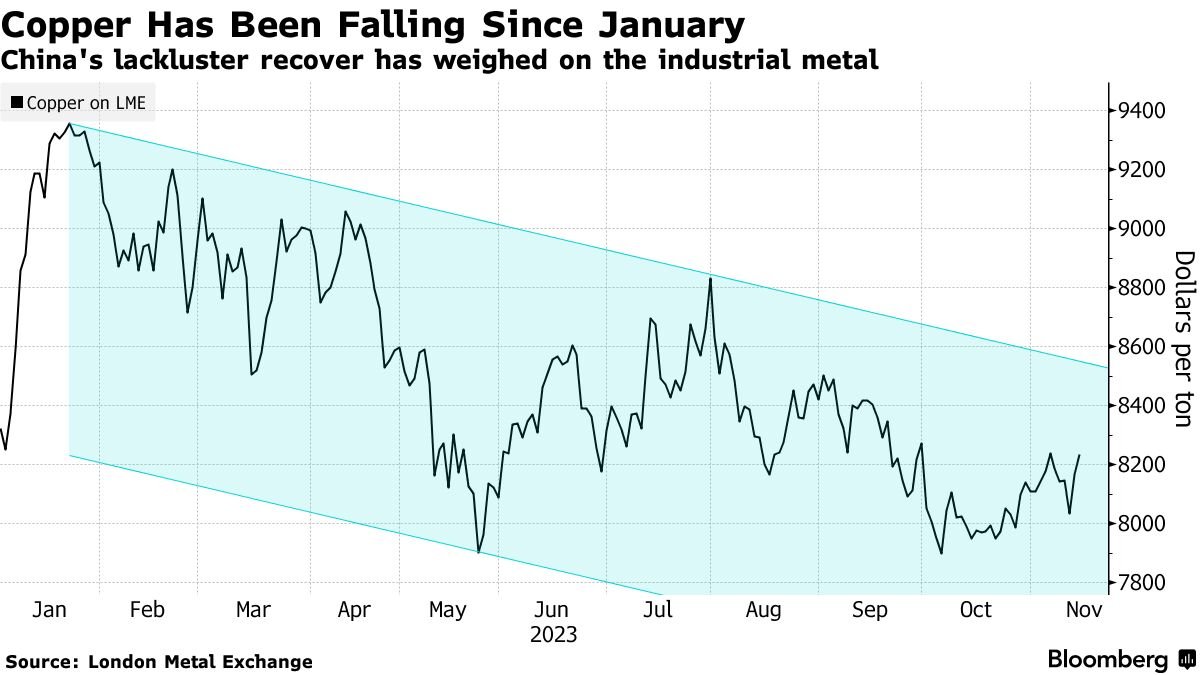

The copper market experienced a sharp rally from November to mid-January, fueled by optimism surrounding China’s economic rebound after easing Covid restrictions. Nevertheless, copper has steadily declined throughout 2023 due to global monetary tightening and a slower-than-expected Chinese recovery, despite recent stimulus efforts from Beijing.

Shanghai Wooray Metals Group, established in 2015, supplied nearly 2 million tons of refined copper to around 1,700 clients last year, constituting approximately 15% of China’s total demand. The company typically procures metal from large trading houses and distributes it to its primarily fabricator-based customer network.

As a privately-owned firm, Wooray is gaining significance just as the Chinese government intensifies efforts to crackdown on dubious commodities deals by state-owned companies. Wang suggests that a “fully competitive” market should benefit Wooray.

However, the broader economic strain is evident as Maike Metals International Co., responsible for over a quarter of China’s copper imports until recently, filed for bankruptcy this week, grappling with a liquidity crisis.

Despite the overall market challenges, there are bright spots for copper demand, particularly from China’s power grids and the electric vehicle industry, offsetting weakness from the embattled property sector, according to Wang. He predicts a shift in China’s refined copper market from a tight balance this year to a surplus of 600,000 tons in 2024 after adding another 800,000 tons of processing capacity.

While Wang did not provide specific price forecasts, he noted that any rise in Chinese prices above 69,000 yuan ($9,513) a ton would likely be met by short-selling, reflecting concerns of a potential decline. Currently, copper futures in Shanghai trade around 67,660 yuan a ton.

Looking ahead, Wang highlights the importance of monitoring rising supplies of copper scrap in China as white goods, purchased by the emerging middle class, approach the end of their lifespan, impacting long-term supply dynamics. The evolving situation in the copper market poses challenges and opportunities, necessitating a close watch on developments with global implications.