Renowned U.S. venture capital firm Andreessen Horowitz has taken a significant leap by backing London-based insurtech startup Hyperexponential.

In a strategic move to revolutionize the insurance industry, renowned U.S. venture capital firm Andreessen Horowitz has taken a significant leap by backing London-based insurtech startup Hyperexponential in a substantial $73 million funding round, as revealed by the innovative insurance software company on Thursday.

This latest injection of capital was orchestrated by Battery Ventures, marking a pivotal moment for Hyperexponential as it positions itself at the forefront of mathematical modeling software for insurance companies.

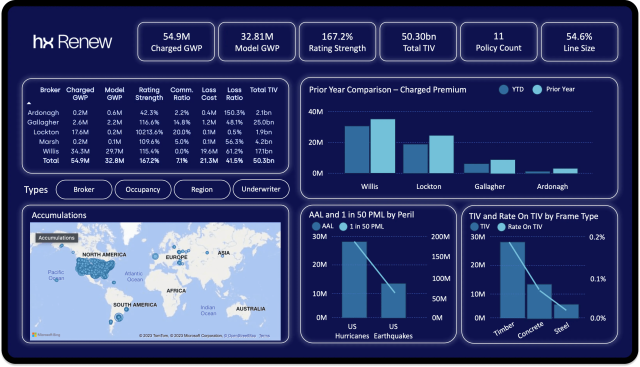

Established in 2017, Hyperexponential has been dedicated to providing insurance companies with cutting-edge mathematical modeling software. This technology enables insurers to adeptly price policies based on a diverse array of data, fostering a more nuanced and sophisticated approach to risk assessment. The funding round, led by Battery Ventures, comes at a crucial time for the insurtech startup and the broader European tech landscape.

Amidst a pronounced dip in investment in Europe’s technology sector, Hyperexponential’s successful funding round stands out as a testament to the resilience and attractiveness of companies demonstrating sustained growth and self-sustainability.

According to research from venture capital firm Atomico, investments in Europe’s tech sector are projected to plummet from $82 billion in 2022 to $45 billion in 2023, highlighting a challenging investment climate.

Hyperexponential’s Co-founder and CEO, Amrit Santhirasenan, expressed gratitude for the continued support, emphasizing the company’s resilience in the face of market challenges. “There is still appetite for businesses that are doing very well, that are self-sustaining, and are growing. We are fortunate enough to fall into that group,” remarked Santhirasenan.

The recent success of Hyperexponential is in stark contrast to the trend observed in the European tech landscape, with notable instances like U.S. investment firm Coatue deciding to wind down its London office. The decision to streamline operations, as outlined in an internal memo, reflects a broader sentiment of caution and reevaluation among investors.

In response to inquiries about Hyperexponential’s triumph amid the European investment downturn, Santhirasenan highlighted a shift in the approach to business growth. “In the past, companies have been dependent on external capital, grown as quickly as possible, raised more money, and then seen what happened. That era seems very far behind us,” he remarked, underlining the evolving strategies adopted by successful companies in navigating the dynamic investment landscape.

Angela Strange, General Partner at Andreessen Horowitz, shed light on the insurtech sector’s potential and the necessity for modernization within the insurance industry.

“Insurance is one of the largest industries in the world, but many companies don’t have a modern data stack. They’re working with very old tools,” said Strange. She emphasized that companies are willing to invest significantly in solutions that enhance efficiency and contribute to the improvement of their top lines.

The infusion of $73 million in funding will empower Hyperexponential to double its current headcount, reaching approximately 200 employees. Additionally, the company plans to channel resources towards expanding its presence in the United States, with the imminent opening of a New York office later this year. This strategic move aligns with Hyperexponential’s vision of capitalizing on the robust opportunities present in the U.S. insurance market.

As Hyperexponential forges ahead with its ambitious expansion plans and technological advancements, its success story serves as a beacon of optimism in a European tech landscape grappling with a challenging investment climate. The ability of insurtech startup to secure substantial funding amidst industry headwinds underscores the enduring appeal of companies prioritizing sustainable growth and innovation.