According to a statement from Razorpay, the new Curlec Payment Gateway will support more than 5,000 businesses and has a target of RM10 billion in annualised GTV by 2025.

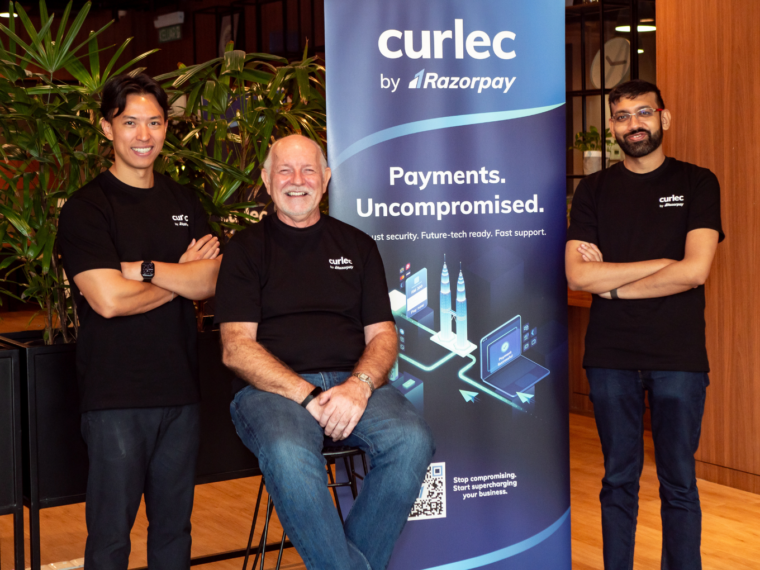

With the introduction of Curlec, now known as “Curlec By Razorpay,” its first international payment gateway, fintech unicorn Razorpay has increased its market share in Malaysia.

In February of last year, Razorpay acquired the Malaysian start-up Curlec in a $20 million deal. The Curlec Payment Gateway aims to close the gap between domestic and international payment gateways by utilising Razorpay’s technology, which serves 10 million businesses in India.

Curlec, a company that specialises in recurring payments, currently collaborates with over 700 Malaysian companies, including CTOS, Courts, Mary Kay, Tune Protect, and The National Kidney Foundation.

According to a statement from Razorpay, the new Curlec Payment Gateway will support more than 5,000 businesses and has a target of RM10 billion ($2.1 billion) in annualised Gross Transaction Value (GTV) by 2025.

The Curlec Payment Gateway is a first step in that direction, according to Shashank Kumar, MD and cofounder of Razorpay India. “When we joined forces with Curlec, our one single vision was to build products catering to the needs of the SEA region,” he said.

“We recognise the power of payments in Malaysia and what it means for businesses of all types and sizes, and we see tremendous potential in the SEA. We firmly believe that our vast operating experience in India’s diverse and dynamic market has equipped us to handle various challenges and resolve payment issues on a global scale.

Razorpay hopes to benefit from Malaysia’s expanding digital economy. According to a report from 2021, digital trade in Malaysia contributed 22.6% to the total GDP of the nation, with a projected increase to 25.5% by 2025.

The three keys to unlocking the potential of digital payments and promoting economic growth in Malaysia, according to Kumar, are collaboration, innovation, and customer-centricity. “Having observed India’s payment geography and discovering similarities with Malaysia, I can boldly say that.”

According to fintech unicorn Razorpay, the fintech startup’s launch in Malaysia will open up new opportunities for growth in emerging markets around the world.

In the meantime, Razorpay keeps improving its domestic capabilities to keep up with the nation’s changing digital payments ecosystem. It introduced “Turbo UPI” earlier this year, a one-step payment solution for the UPI network.