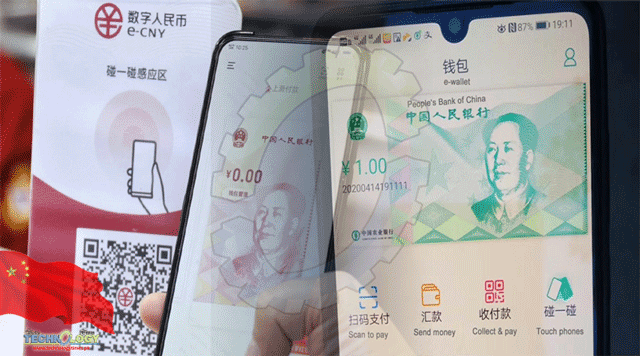

China’s digital yuan wallet app has become one of the country’s most downloaded apps within just a week of launching, a development that could disrupt a consumer payment market dominated by Alipay and WeChat Pay.

Downloads of the e-CNY app, which currently operates in select cities, exceeded those of WeChat, the super app from Tencent Holdings with its own mobile payment function, to become the most popular app on Apple’s iOS on Wednesday, a day after landing in app stores, according to market researcher App Annie. It retained the top spot through Saturday before falling to second place behind Kuaishou.

By Monday, the app was the second most downloaded financial app in Xiaomi’s app store, after topping the list last Wednesday, according to market researcher Qimai. However, it ranked just 43rd in Huawei’s store on Monday, 10 spots higher than the previous day. Both stores are popular options for Android users in mainland China, where Google Play is blocked.

The e-CNY app’s popularity could be a positive sign for efforts from the People’s Bank of China to promote its central bank digital currency (CBDC), officially called the Digital Currency and Electronic Payment (DCEP), ahead of the 2022 Winter Olympics next month.

The central bank’s Digital Currency Research Institute, which developed the app, has been studying the implementation of a digital yuan for years. Trials of the digital yuan started in 2020, and the institute has partnered with local authorities to hand out e-yuan red packets to citizens in ten pilot cities, including Shanghai, Shenzhen, Xiongan, Chengdu, Suzhou and Winter Olympics venues in Beijing.

While the app is broadly available for download, it is currently only usable in designated cities.

The payment turnover and user base of the digital yuan is still tiny compared with the mobile payment titans WeChat Pay and Alipay, which is owned by Ant Group, the fintech affiliate of Alibaba Group Holding, owner of the South China Morning Post. Together, the two entrenched tech giants make up 90 per cent of China’s mobile payments market.

Red packets, a digital version of a traditional holiday gift in the form of an envelope of cash, along with other incentives have so far helped drive interest in trying out the new app.

Chengdu resident Robin Deng said he downloaded the app last year and has been using it frequently since October to get discounts on public transport and shared bikes from Meituan.

“I get 50 per cent off when using digital yuan to take the subway,” he said. “Paying with e-CNY is similar to WeChat Pay and Alipay.”

Beijing resident Lily Zhang tried it last September at the China International Fair for Trade in Services, where she used the digital currency to buy drinks and an ice-cream.

“It was very convenient, as one can use it even without an internet connection,” Zhang said. If it were accepted widely across Beijing, she added, she would use it more because “it is relatively safe”.

However, Alipay and WeChat Pay both allow users to pay while offline, and most mobile users in China already have these apps. That could make it hard for e-CNY to maintain momentum when the discounts and other incentives dry up.

China woos new digital yuan users in major push

Howard Qian, another Chengdu resident, removed the app from his phone days ago over lack of use. “The money I topped up in the e-CNY wallet won’t turn out any deposit interest,” he said. “I’d rather store it in the money market funds in WeChat or Alipay.”

Qian added that he would only use the e-CNY app again if he could keep getting subsidies.

May Lu, a resident of Beijing, said she was not impressed by e-CNY and that installing another payment app on her phone felt unnecessary.

“I don’t think e-yuan offers huge advantages to users currently, especially for those in the big cities where third-party e-payment services are ubiquitous,” said Wang Leilei, an analyst at Shanghai-based financial industry consultancy Kapronasia. “In the lower-tier markets in small cities … it might stand a chance.”

While conducting research and development of a CBDC, the Chinese government has also become increasingly hostile towards cryptocurrencies such as bitcoin. Last year, it ramped up a crackdown on bitcoin mining, pushing most activity out of the country, and issued a blanket ban on cryptocurrency exchanges.

The government has stated that the digital yuan is designed to replace coins and notes in circulation, but the push to digitise cash has also fanned concerns of enhanced state surveillance on transactions.

The digital yuan is not just limited to the e-CNY app. It can be used across many mobile payment apps in China, including Alipay, WeChat Pay and the apps of seven Chinese banks – the Industrial and Commercial Bank of China, Agricultural Bank of China, China Construction Bank, Bank of China, Bank of Communications, Postal Savings Bank of China and China Merchants Bank.

Chinese cryptocurrency investors not pulling out despite exchange exodus

About 140 million Chinese residents had opened a digital yuan account as of October 2021, with accumulated transactions reaching 62 billion yuan (US$9.7 billion) since launch, Mu Changchun, head of the Digital Currency Research Institute, said in November.

China’s strengthened efforts to promote DCEP come just weeks before the Lunar New Year, a week-long holiday in mainland China that begins on February 1 and is a popular time for gifting red packets. It also comes just ahead of the Winter Olympics, which kicks off on February 4.

China has yet to announce a formal timetable for the nationwide launch of the DCEP, but the central bank has said that foreign visitors to the Olympics will be able to use the digital yuan without a Chinese bank account.

Source: Yahoo Finance