Karandaaz Pakistan has launched a state-of-the-art online data portal with aggregated data on financial services and selected socioeconomic indicators.

Karandaaz Pakistan has launched a state-of-the-art online data portal with aggregated data on financial services and selected socioeconomic indicators for the country, says a press release.

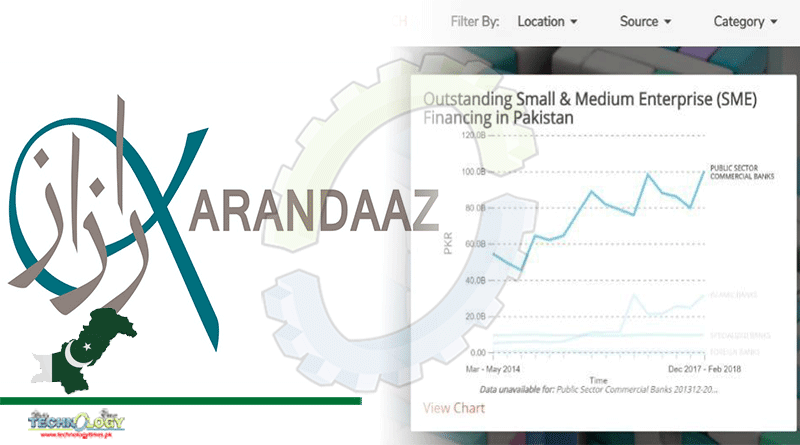

The data on the portal covers segments such as demographics, national economic data, agriculture finance, financial access, and behaviors of individuals, banking infrastructure and transactions, micro, agri, and SME financing, housing finance, non-bank financial institutions (NBFIs), mobile money, and telecommunications statistics.

The portal is interactive, intuitive, visually appealing and easy to navigate. It also offers the capability to generate bespoke data dashboards and has filtering and layering functionality. A webinar to highlight the various features of the data portal and the significance of credible and easy-to-access financial data for decision-makers was recently held by Karandaaz.

Drawing on publicly available information from reputable sources, the breadth of information contained in the portal will expand over time with the addition of new data categories and metrics accompanied by continuous backend upgrades. The portal can be accessed at https://karandaaz.com.pk/karandaazportal/

Talking about the significance of credible data for policymakers, the Chairperson of Karandaaz Pakistan Dr. Shamshad Akhtar said, “Good-quality and open and easy access to statistics and data is critical for Pakistan’s sound policy making and project design. As we come out of the shadows of the pandemic, digital connectivity to, among others, deepen financial inclusion have emerged to be sustainable solution to reduce poverty and rejuvenate the economy. Pre-COVID gaps in financial inclusion have been glaring. KRN has been working with the Government, regulator and all stakeholders to realize the vision of the National Financial Inclusion Strategy and meet the targets of enhancing financial inclusion across gender and geography. KRN has supported the development of core infrastructure of the digital financial inclusion including technology and payment solutions. These endeavors are reinforced by KRN initiatives to institutionalize vehicles to finance micro and small businesses and institute supportive credit enhancement. Within this context, timely and reliable statistics and data portal will play a critical role in the design of futuristic policies and monitoring of ground progress. Devising strategies that can lead the country towards sustained financial progress. Policymakers, development partners, corporates, researchers and academia, and entrepreneurs, all have a need for statistics on the financial sector for identifying trends, learning from successes, ascertaining gaps, and mapping a necessary course of action in order to make interventions that can reap the best dividends for the economy. Informed decisions backed by metrics, facts, and figures are the best decisions and that is precisely why we at Karandaaz felt that a sophisticated data portal where information is available for sound decision making is critical.”

Sima Kamil, deputy governor State Bank of Pakistan said, “As a regulator of the financial sector of any country, the central bank’s reliance on credible data for making policies that are likely to trigger growth and progress are fundamental.

Originally Published at The News