China Must Pursue Breakthroughs In Chip Assembly And Packaging Technologies To Catch Up With Global Industry Leaders, According To Experts.

China Must Pursue Breakthroughs In Chip Assembly And Packaging Technologies To Catch Up With Global Industry Leaders, According To Experts Who Spoke On Wednesday At The World Semiconductor Conference Held In The Eastern City Of Nanjing.

The world’s second-largest economy now has an opportunity to catch up as the semiconductor industry grapples with maintaining annual growth in chip performance, which declined to 3 per cent this year from a high of 57 per cent in 2002, said Wu Hanming, a fellow at the Chinese Academy of Engineering (CAE), according to conference transcripts obtained by the South China Morning Post.

The focus on integrated circuit (IC) assembly and packaging innovations falls in line with a call by Chinese officials for potential disruptive semiconductor technologies, as Moore’s Law potentially reaches its physical limit. First observed by Intel co-founder Gordon Moore in 1965, Moore’s Law has become a “rule of thumb” on advances in computing power. It maintains that the number of transistors on a chip doubles roughly every two years, while the overall cost of that computing power halves.

One way China can stay ahead of the industry is through “heterogeneous integration”, according to Mao Junfa, vice-president of Shanghai Jiao Tong University and an academic with the Chinese Academy of Sciences. “Heterogeneous integration is the new direction for the industry in the post-Moore’s Law era,” Mao said. “It is also an opportunity for China to change lanes and overtake others in the IC industry.” That entails the integration of separately manufactured components into a higher-level assembly, also known as system-in-a-package.

Advanced packaging, in which a set of ICs are combined to form a powerful semiconductor, would help extend Moore’s Law, according to Zheng Li, chief executive at chip firm Jiangsu Changjiang Electronics. An example of that are chiplets, IC blocks designed to work with other chiplets to form larger and more complex semiconductors. Chiplet-based design is expected to ease the economics of manufacturing chips with a large amount of transistors. Initiatives to build up the domestic semiconductor industry have become the focal point in the escalating trade and tech war between the US and China.

On Tuesday, the US Senate passed the landmark US Innovation and Competition Act, identifying China as a major rival to the county’s technological dominance. The bill provisions billions of dollars to help boost American semiconductor manufacturing, as Washington seeks to reverse what it sees as the country’s dangerous reliance on Chinese supply chains.

“We are in a competition to win the 21st century, and the starting gun has gone off,” US President Joe Biden said in a statement after the bill cleared the Senate. “As other countries continue to invest in their own research and development, we cannot risk falling behind. America must maintain its position as the most innovative and productive nation on Earth.”

Echoing recent sentiments from China’s state media, CAE’s Wu said globalisation is an “irreplaceable path” for the development of the world’s semiconductor industry, as the value chain is long and wide-ranging. “The development of ICs has to be globalised,” Wu said. “There’s no future for unilateralism pushed by certain countries.” Some analysts, however, are not bullish about China’s efforts in assembly and packaging. “The overall level of China’s semiconductor companies, when it comes to advanced packaging, lags behind those of global players,” Richard Chen, president of applied technologies at Hangzhou-based silicon wafer manufacturer Ferrotec Group, said last month.

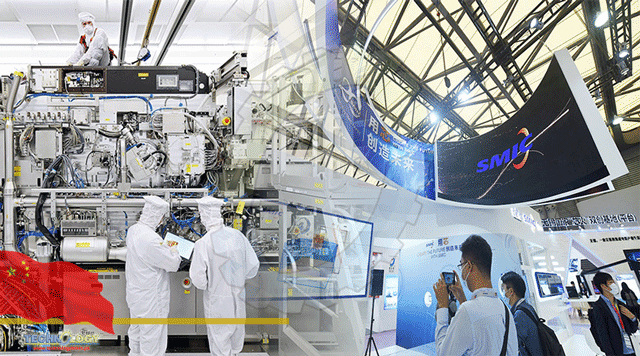

It would be wrong to expect China to take the lead in the IC industry as Moore’s Law slows, according to semiconductor analyst Xin Yang last month, because the US remains the leader in developing advanced chip technologies. Still, Chinese firms have remained aggressive in building up their capabilities. China vaulted to the No 1 spot for semiconductor equipment sales for the first time in 2020, surpassing Taiwan, South Korea and Japan, according to data from trade group SEMI. The equipment purchases include those for wafer processing, assembly, packaging and testing.

The Chinese government has showered the domestic chip sector with favourable policies, from tax rebates to state subsidies, for any new plant capable of producing chips at the 28-nanometre node or lower, to fast track its development. As part of the 14th five-year plan, Beijing aims to increase the country’s spending on basic scientific research, including on semiconductors, to 8 per cent of total research and development expenditure.

Separately, China’s customs authority has waived import duties for semiconductor equipment through to 2030. China, however, is still banned from buying the most advanced equipment needed to produce chips at leading edge nodes, including extreme ultraviolet lithography machines. In a welcome development, the number of newly registered chip-related companies in China more than tripled in the first five months of this year from the same period in 2020.

This news was originally published at SCMP.